Executive Summary

Applied Industrial Technologies (AIT) is a market-leading value-added distributor and technical solutions provider of mission-critical industrial motion, fluid power, flow control, automation technologies and related maintenance supplies. The key to their business is a highly technical and localized service organization that sits on top of a vast industrial supplier network, making AIT the go-to option for urgent break-fix calls for mission critical components. Amazon competition, mom & pops are at a distinct disadvantage due to procurement, systems, freight and other scale-related detractors, and larger players like Amazon do not care to invest in the physical locations, highly technical engineers and rapid delivery that is required of AIT’s customers. Considering that at least 65-70% of their TAM is occupied by mom & pops, AIT is in a prime position to take share.

AIT also stands to capitalize on booming US industrial activity, increased regulation, and adoption of automation as their national footprint, scalability and ample M&A firepower allow them to outgrow the market. Key to their expansion is their utilization of the services business for wallet share gains through cross-selling, along with their organic and inorganic growth in the expanding markets of fluid power, flow control, automation, and smart technology. While management has skillfully improved the balance sheet, margins, and returns through artful capital allocation, this business does not require a genius at the helm.

While the stock has performed incredibly well lately, upside remains as key cyclical indicators—MCU, MIP, and ISM PMI—indicate that we are early-cycle, which is when distributors tend to perform especially well. A premium to historic multiples is also justified given improvements in ROIC, leverage, margins, and diversified exposure to secular trends.

Close proximity to customers => sticky relationships => high pricing power & barriers to entry

A superior level of expertise for servicing mission critical technologies, close proximity to customers and familiarity with their facilities and capability to produce customized solutions are the keys to customer stickiness. AIT’s customers are deeply embedded, leading to strong pricing power.

AIT's clients expect them to maintain 100% reliability, ensuring that they have the required parts and expertise available immediately, given the critical nature of break-fix tasks where downtime on an industrial line equates to financial loss. Few peers can offer this.

Persistent labor shortages have heightened customer dependence on AIT for essential services, including break-fix, engineering and design, inventory management, systems integration, and fabrication & assembly.

AIT offers a nationwide one-stop shop for over 8.5 million SKUs, allowing its customers to consolidate their distributors.

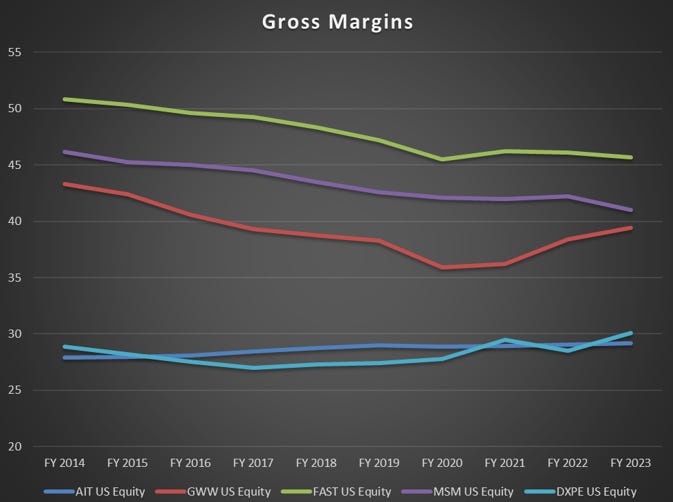

Strong pricing power is demonstrated through its remarkably steady and consistently growing gross margins, which are nearing 30%. Margins have expanded by 40-50 bps p.a. since 2010.

A compounder that is poised to capitalize on the transformation of the US industrial economy

AIT is exposed to secular drivers such as industrial automation, increasingly sophisticated industrial processes, reshoring of supply chains, growth of US manufacturing, adoption of flow control/fluid power systems, and utilization of aged infrastructure.

Expansion into new segments like Automation and Smart Technologies provides high optional upside.

AIT and Motion (part of GPC) have a combined ~15-20% market share with a wide gap between them and all other competitors. This gives them distinct advantages in procurement, freight, systems and most importantly, reliable rapid deliveries.

Cross-selling is a focus of the services business and has the potential to drive LSD growth itself.

M&A is a key driver of growth, and while this has slowed lately due to high costs of capital and high seller expectations, their strong balance sheet gives them ample firepower to grow when prices normalize.

Margin accretive acquisitions are the main margin driver, but margins will also benefit from operational efficiency programs and positive mix shift towards higher margin class-C consumables, flow control & fluid power segment. This should lead to 20-30bps EBITDA margin expansion p.a.

A stable business with downside protection in cyclical end markets

While AIT is exposed to cyclical end markets, they have downside protection on several fronts, one of which is their highly diversified customer & supplier bases. No customer >4% of sales and top 25 suppliers are only ~30% of purchases.

Since AIT works with mission-critical components where cheap foreign components are not considered, most suppliers are in developed markets, de-risking their supply chain.

They are a market leader with 80% of sales come from either a #1 or #2 market position. Massive players like Amazon are not a risk to this market position as they do not want to invest in physical stores, highly technical engineers and immediate delivery.

Their financial standing is solid thanks to their near-zero ND/EBITDA and consistent FCF which averaged 104% of net income over the last 10 years. This consistent FCF generation allows management to buyback shares and make opportunistic acquisitions in a downturn.

Capex consistently stays <1% of sales, creating a resilient, capital-light model.

While M&A is a key to the growth story, management has avoided overextending themselves as they have not grown the asset base too quickly or issued equity to acquire. This is shown by their 2nd quintile Investment Quality score.

Managers are incentivized intelligently with annual targets based on net income and working capital and LT incentives based on ROA and EBITDA growth.

Valuation upside

The stock has returned 33.97% p.a. over the last 5 years and trades 23% above its 5-year average P/E ratio, so upside may appear limited, but I believe there is still room to grow.

While the stock has re-rated recently, the business has also drastically improved from 2018 levels as its ND/EBITDA is 92% lower, ROIC is 58% higher and EBIT margin 340 bps wider, indicating the elevated multiple is justified.

EBIT margin and multiples are highly correlated for industrial companies, and we expect multiples to continue to expand.

The stock trades at a consistent 30% discount to Grainger & Fastenal, so as those stocks continue to perform, so should AIT. This has implications to the downside as well.

Discovery upside is high as the stock is only covered by 3 analysts and 0 bulge brackets.

Risks

The biggest risk the business faces is the industrial cycle due to their end market exposure. Services revenue declined 11% in 2002, 14% in 2009 and 7% in 2016.

As an acquisitive business, when capital markets become restrictive, it can be difficult to find suitable acquisition candidates, requiring the business to lean more on organic growth. We are seeing that play out now.

While they have high goodwill and intangible assets from acquisitions, these do not present much of an impairment risk as these are highly cash flow generative businesses.

Peer Comparison

Chart 1: Thematic growth and cross-selling drive 7-11% earnings growth

Chart 2: Profitability metrics indicate a bumpy road but an undeniable upward trend

Source: Bloomberg Data

Chart 3: Stable & consistent gross margin expansion while larger peers struggle

Source: Bloomberg Data

Chart 4: Management commitment to reducing leverage resulting in a stable business and ample M&A firepower

Source: AIT Investor Presentation https://s24.q4cdn.com/112631158/files/doc_financials/2024/q2/Investor-General-Presentation-January-2024-v2.pdf

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e